Did you know that the money you pay to Uncle Sam might be eligible for a deduction on your tax return? That's right, you may be able to deduct federal income taxes paid on your return.

If you're like most people, you probably don't think much about your taxes until it's time to file. But if you're looking to save money on your taxes, it's important to understand what deductions you're eligible for.

One deduction that you may be overlooking is the deduction for federal income taxes paid. This deduction allows you to reduce your taxable income by the amount of federal income taxes you paid during the year.

The deduction for federal income taxes paid is available to both individuals and businesses. To claim the deduction, you must itemize your deductions on Schedule A of your tax return. The amount of the deduction is limited to the amount of your taxable income.

Can you deduct federal income taxes paid?

There are many essential aspects to consider when determining whether you can deduct federal income taxes paid. These include:

- Your filing status

- Your income

- Your deductions

- The type of taxes you paid

- The year you paid the taxes

- Whether you itemize your deductions

- The amount of your standard deduction

- The limits on itemized deductions

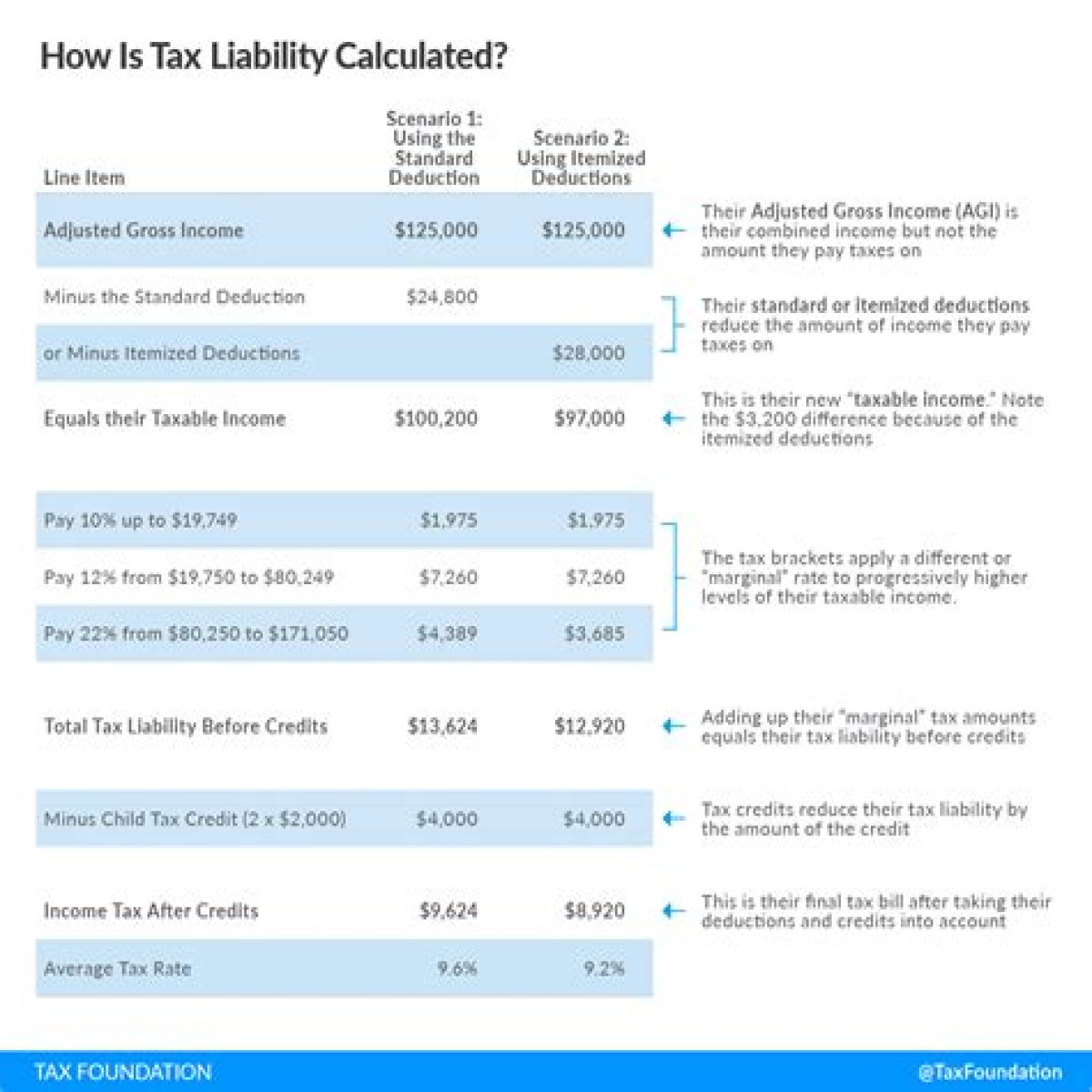

These aspects are all interconnected, and they can have a significant impact on your ability to deduct federal income taxes paid. For example, if you itemize your deductions, you can deduct the amount of federal income taxes you paid up to the amount of your taxable income. However, if you take the standard deduction, you cannot deduct any of the federal income taxes you paid.

It is important to understand all of the aspects involved in deducting federal income taxes paid so that you can make the best decision for your tax situation. If you have any questions, you should consult with a tax professional.

Can You Deduct Federal Income Taxes Paid?

If you're like most people, you probably don't think much about your taxes until it's time to file. But if you're looking to save money on your taxes, it's important to understand what deductions you're eligible for.

One deduction that you may be overlooking is the deduction for federal income taxes paid. This deduction allows you to reduce your taxable income by the amount of federal income taxes you paid during the year.

Who Can Deduct Federal Income Taxes Paid?

The deduction for federal income taxes paid is available to both individuals and businesses. To claim the deduction, you must itemize your deductions on Schedule A of your tax return.

How Much Can You Deduct?

The amount of the deduction is limited to the amount of your taxable income. This means that if you have a lot of other deductions, you may not be able to deduct all of your federal income taxes paid.

Is It Worth It to Deduct Federal Income Taxes Paid?

Whether or not it's worth it to deduct federal income taxes paid depends on your individual tax situation. If you have a lot of other deductions, it may not be worth it to itemize your deductions just to claim this deduction.

However, if you don't have many other deductions, deducting federal income taxes paid can be a great way to save money on your taxes.

This article has explored the topic of "can you deduct federal income taxes paid", providing insights into the eligibility, limitations, and potential benefits of this deduction. The article has highlighted key points such as the availability of the deduction to both individuals and businesses, the requirement to itemize deductions on Schedule A of the tax return, and the limitation of the deduction to the amount of taxable income.

The article has also discussed the interconnections between the deduction for federal income taxes paid and other aspects of the tax code, such as the standard deduction and the limits on itemized deductions. The article concludes by emphasizing the importance of understanding the rules and limitations surrounding this deduction in order to make informed decisions about tax planning.

Harry Lyles Jr. Age: How Old Is He Really?What's Casey Anthony Up To These Days?Who's The Lucky Lady? Uncovering The Mystery Of Rick Gonzalez's Wife